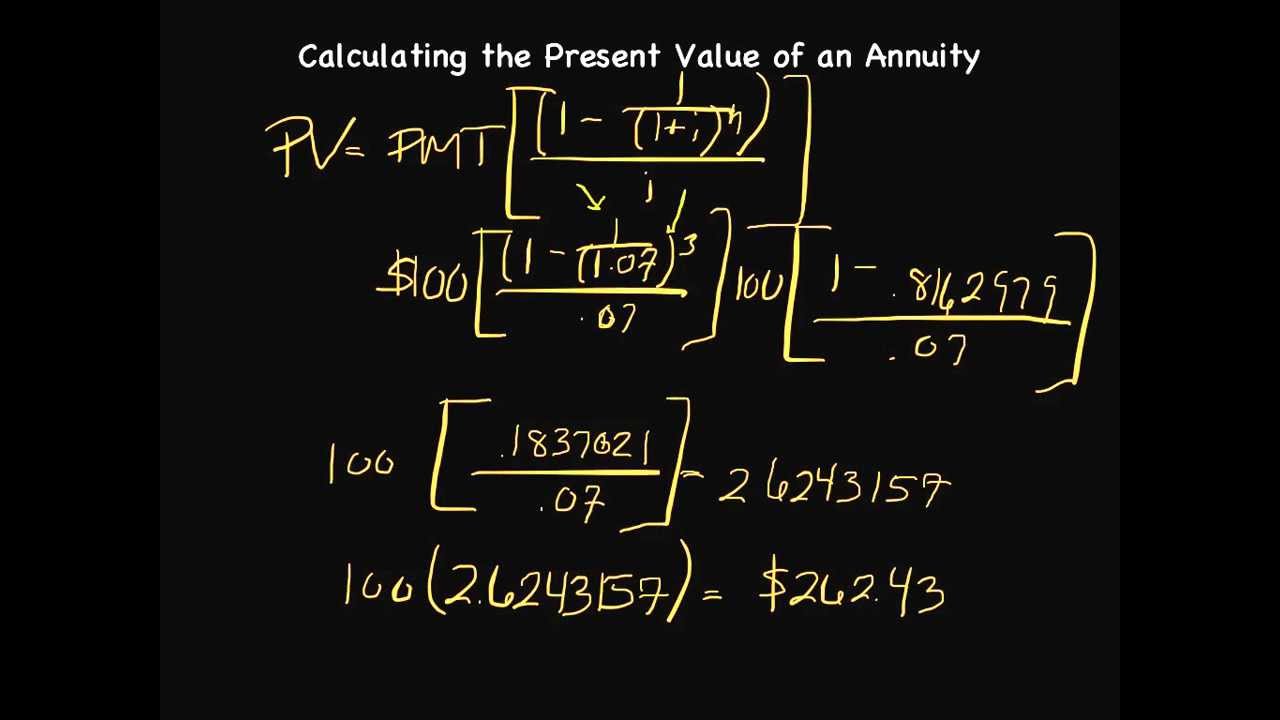

We might use the analogy of a doorstep lender who adds the interest to the capital before the first payment is made and the interest plus the capital is the total amount to be repaid as if the interest plus the capital is wholly the capital. That means that if the loan is repaid early there isn't any interest to be saved because that interest has already been paid and what is cleared is the remaining loan capital. Gradually, as the outstanding loan balance reduces, interest amount also decreases and the loan. At the beginning, interest amount is higher. The monthly installment remains constant but principal and interest are paid off in different amounts each month. In that case there cannot be a reducing monthly balance. Amortization is the process of paying off a loan or mortgage in a series of fixed payments. Why front-loaded interest is disliked is that early repayments go to paying the interest and not the capital. interest charged on the reducing balance is the type of loan structure that people complain about as Front Loaded because they mistakenly think that interest should be evenly spread throughout the term of their loan. What you describe as the opposite to Front Loaded Interest i.e. The term "Front Loaded Interest" gets bandied about far too much. What you are calling Front Loaded Interest isn't really - You pay monthly interest on the reducing outstanding balance on ALL the loan types you mention so naturally you pay more interest at the start of the loan when you owe more. The opposite to front-loading and generally regarded as fairer is paying interest every month on the reducing outstanding balance which could get expensive depending on the interest rate and the capital sum. We find it in personal loans, car finance, mortgages and across the whole finance sectors. Presumably you knew what the repayment terms were at the time you took it out so they cannot be bullying, they just want you to adhere to your end of the bargain.įront-loading of interest is actually more common that we might think.

0 kommentar(er)

0 kommentar(er)